All Categories

Featured

Table of Contents

Inherited annuities come with a death benefit, which can give financial security for your loved ones in the event of your fatality. If you are the recipient of an annuity, there are a couple of policies you will certainly need to comply with to acquire the account.

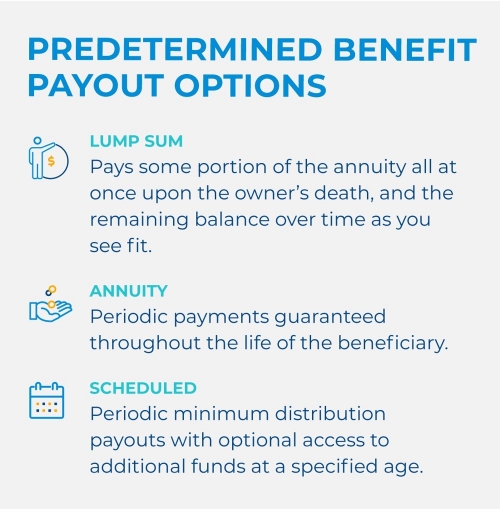

Third, you will certainly require to offer the insurance company with various other called for documentation, such as a copy of the will or trust. Fourth, relying on the kind of acquired annuity and your individual tax circumstance, you might require to pay tax obligations. When you acquire an annuity, you need to pick a payment option.

With an instant payout option, you will begin getting payments as soon as possible. Nevertheless, the settlements will certainly be smaller than they would certainly be with a postponed alternative since they will certainly be based upon the present value of the annuity. With a deferred payout option, you will certainly not start getting settlements later.

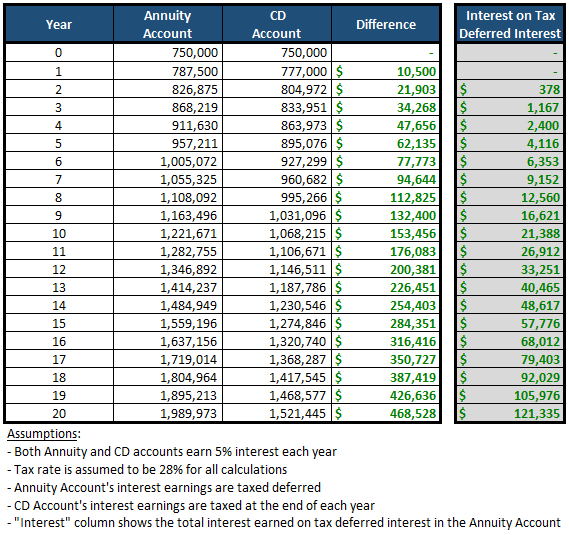

When you acquire an annuity, the taxation of the account will certainly rely on the kind of annuity and the payout option you pick. If you inherit a typical annuity, the repayments you receive will certainly be exhausted as regular income. However, if you acquire a Roth annuity, the payments you receive will not be exhausted.

Taxes on inherited Tax-deferred Annuities payouts

If you choose a deferred payment alternative, you will not be tired on the growth of the annuity till you start taking withdrawals. Talking to a tax consultant before acquiring an annuity is very important to ensure you recognize the tax obligation ramifications. An inherited annuity can be a wonderful means to offer financial protection for your liked ones.

You will likewise require to adhere to the rules for inheriting an annuity and select the appropriate payout option to match your needs. Be certain to talk with a tax advisor to ensure you recognize the tax obligation implications of acquiring an annuity - Retirement annuities. An acquired annuity is an annuity that is passed down to a recipient upon the fatality of the annuitant

To inherit an annuity, you will require to offer the insurance company with a copy of the fatality certification for the annuitant and fill in a recipient type. You might require to pay tax obligations depending upon the type of acquired annuity and your personal tax obligation circumstance. There are 2 primary kinds of acquired annuities: traditional and Roth.

If you inherit a conventional annuity, the settlements you obtain will be strained as normal income. If you acquire a Roth annuity, the payments you obtain will certainly not be tired.

Taxes on inherited Annuity Death Benefits payouts

How an inherited annuity is taxed relies on a variety of factors, however one trick is whether the cash that's coming out of the annuity has been strained before (unless it remains in a Roth account). If the cash dispersed from an annuity has not been taxed before, it will be subject to tax.

A professional annuity is one where the owner paid no tax on contributions, and it might be held in a tax-advantaged account such as conventional 401(k), traditional 403(b) or conventional individual retirement account. Each of these accounts is moneyed with pre-tax money, implying that tax obligations have actually not been paid on it. Considering that these accounts are pre-tax accounts and earnings tax has actually not been paid on any one of the cash neither contributions neither incomes circulations will undergo normal earnings tax.

A nonqualified annuity is one that's been acquired with after-tax cash, and distributions of any type of contribution are not subject to income tax obligation since tax obligation has actually currently been paid on payments. Nonqualified annuities consist of 2 major kinds, with the tax therapy depending upon the type: This sort of annuity is bought with after-tax money in a normal account.

:max_bytes(150000):strip_icc()/do-beneficiaries-pay-taxes-life-insurance.asp-final-7e81561536514dbdb30500ba1918afb3.png)

Any normal circulation from these accounts is free of tax obligation on both contributed money and revenues. At the end of the year the annuity company will file a Kind 1099-R that reveals exactly how much, if any, of that tax obligation year's circulation is taxed.

Beyond earnings tax obligations, a successor may likewise need to determine estate and estate tax. Whether an annuity goes through income taxes is a completely different matter from whether the estate owes inheritance tax on its worth or whether the beneficiary owes estate tax on an annuity. Inheritance tax is a tax analyzed on the estate itself.

The rates are dynamic and range from 18 percent to 40 percent. Private states might also levy an estate tax on money dispersed from an estate. In comparison, inheritance tax obligations are tax obligations on a person who receives an inheritance. They're not examined on the estate itself but on the beneficiary when the properties are received.

How is an inherited Guaranteed Annuities taxed

government does not assess inheritance taxes, though 6 states do. Fees variety as high as 18 percent, though whether the inheritance is taxed relies on its size and your relationship to the provider. Those acquiring big annuities should pay attention to whether they're subject to estate taxes and inheritance tax obligations, past simply the typical earnings taxes.

Beneficiaries should focus on potential inheritance and estate tax obligations, too.

Below's what you need to recognize. An annuity is an economic item offered by insurance policy business. It's an agreement where the annuitant pays a round figure or a series of costs in exchange for a guaranteed revenue stream in the future. What takes place to an annuity after the owner passes away depends upon the certain details detailed in the agreement.

Various other annuities use a fatality benefit. This feature permits the proprietor to mark a recipient, like a partner or kid, to get the remaining funds. The payout can take the type of either the whole continuing to be equilibrium in the annuity or an ensured minimum quantity, generally whichever is better.

It will clearly determine the beneficiary and potentially outline the available payment choices for the death advantage. Having this info useful can help you navigate the process of getting your inheritance. An annuity's survivor benefit assures a payment to a marked recipient after the owner dies. The specifics of this advantage can differ depending on the kind of annuity, when the owner died and any type of optional riders contributed to the contract.

Table of Contents

Latest Posts

Exploring Choosing Between Fixed Annuity And Variable Annuity A Comprehensive Guide to Annuities Fixed Vs Variable Breaking Down the Basics of Choosing Between Fixed Annuity And Variable Annuity Advan

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Fixed Indexed Annuity Vs Market-variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment C

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Annuities Variable Vs Fixed Advantages and Disadvantages of Choosing Between

More

Latest Posts