All Categories

Featured

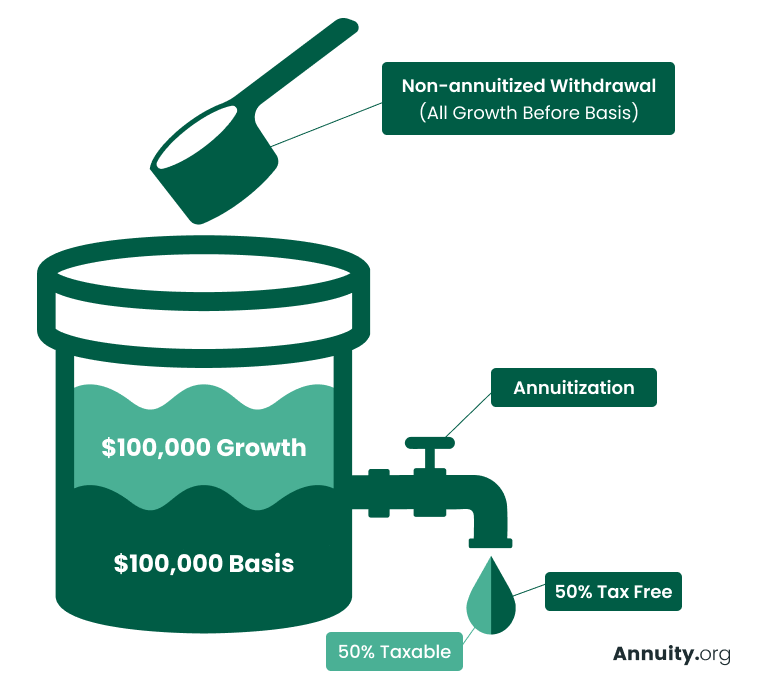

Two people acquisition joint annuities, which supply a guaranteed income stream for the rest of their lives. If an annuitant passes away throughout the distribution duration, the staying funds in the annuity might be handed down to an assigned beneficiary. The details alternatives and tax obligation ramifications will certainly depend upon the annuity agreement terms and appropriate legislations. When an annuitant passes away, the interest made on the annuity is managed in different ways depending on the kind of annuity. Most of the times, with a fixed-period or joint-survivor annuity, the rate of interest continues to be paid to the making it through recipients. A death advantage is a function that ensures a payment to the annuitant's recipient if they pass away prior to the annuity settlements are worn down. The availability and terms of the death advantage may vary depending on the particular annuity agreement. A kind of annuity that stops all repayments upon the annuitant's fatality is a life-only annuity. Understanding the conditions of the fatality advantage prior to buying a variable annuity. Annuities are subject to tax obligations upon the annuitant's fatality. The tax obligation treatment relies on whether the annuity is held in a certified or non-qualified account. The funds are subject to income tax obligation in a qualified account, such as a 401(k )or IRA. Inheritance of a nonqualified annuity usually leads to tax only on the gains, not the whole amount.

The original principal(the amount initially transferred by the moms and dads )has actually currently been taxed, so it's exempt to tax obligations once again upon inheritance. The earnings section of the annuity the passion or financial investment gains accrued over time is subject to income tax obligation. Normally, non-qualified annuities do.

have died, the annuity's advantages usually return to the annuity owner's estate. An annuity proprietor is not legally required to notify existing beneficiaries concerning changes to beneficiary designations. The choice to change recipients is normally at the annuity owner's discretion and can be made without informing the existing beneficiaries. Because an estate practically does not exist up until a person has passed away, this beneficiary designation would just enter into result upon the death of the called person. Typically, as soon as an annuity's owner passes away, the designated recipient at the time of death is qualified to the benefits. The partner can not change the beneficiary after the proprietor's fatality, also if the recipient is a minor. Nevertheless, there may be details provisions for taking care of the funds for a minor beneficiary. This typically includes designating a legal guardian or trustee to manage the funds until the kid maturates. Generally, no, as the recipients are not responsible for your debts. It is best to consult a tax expert for a specific answer relevant to your situation. You will continue to receive settlements according to the agreement routine, yet attempting to get a swelling amount or financing is most likely not an option. Yes, in practically all situations, annuities can be acquired. The exception is if an annuity is structured with a life-only payout option with annuitization. This kind of payment ceases upon the death of the annuitant and does not offer any kind of residual worth to successors. Yes, life insurance policy annuities are typically taxable

When taken out, the annuity's incomes are tired as common earnings. Nonetheless, the principal amount (the first investment)is not tired. If a beneficiary is not called for annuity advantages, the annuity continues typically go to the annuitant's estate. The circulation will comply with the probate procedure, which can delay settlements and may have tax effects. Yes, you can call a count on as the recipient of an annuity.

Index-linked Annuities inheritance taxation

Whatever section of the annuity's principal was not already taxed and any type of earnings the annuity built up are taxed as income for the recipient. If you acquire a non-qualified annuity, you will only owe tax obligations on the incomes of the annuity, not the principal utilized to purchase it. Due to the fact that you're getting the entire annuity at as soon as, you have to pay tax obligations on the entire annuity in that tax obligation year.

Latest Posts

Exploring Choosing Between Fixed Annuity And Variable Annuity A Comprehensive Guide to Annuities Fixed Vs Variable Breaking Down the Basics of Choosing Between Fixed Annuity And Variable Annuity Advan

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Fixed Indexed Annuity Vs Market-variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment C

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Annuities Variable Vs Fixed Advantages and Disadvantages of Choosing Between

More

Latest Posts